This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Attracting investors, promoting growth, ensuring a business-friendly environment, supporting digital transformation, improving governance and transparency, etc.

As much as power over these factors is in the hands of private-held businesses, the state is the power behind the throne. The ecosystems they create within the nation’s borders – and the level of regulatory friction companies have to put up with – massively shape the entrepreneurial and business landscape.

Said plainly: Governments lay out the playfield. Businesses decide whether that’s the courtyard they’ll play on and if it’s any good. The better the court, the more businesses come to play – both local and outsiders.

In the following bits, we’ll put courtyards in Nordics and Benelux under some scrutiny. Why these regions you may wonder? Well, these are some of the areas where NetGroup has the experience, and can first-hand vouch that the data below is actually overlapping with state-of-the-art in these regions.

What is Ease of Doing Business?

The ease of doing business is either a subjective or an objective measure displayed as an opinion (subjective) or an index (objective). It represents a metric/opinion that – quite self-explanatory – decides how easy it is for a business to thrive in a certain economy.

In this article, we’ll focus on the last available metrics. Rankings of two different methodologies for countries in the Nordics and Benelux regions: Doing Business by WorldBank and Ease of Doing Digital Business by Tufts University.

The first approach (Doing Business) has been a standard for evaluating business-friendliness for decades, as it was considered a creme of the crop in measuring economic success. It has reportedly led to more than 3,500 reforms across 190 countries. Despite controversy in recent years, it has sparked governments to compete in ensuring more efficient regulatory measures for businesses.

But now, with digital influence growing rapidly, there is an increasing need to measure business-friendliness from a digital perspective. Something EDDB by Tufts University has brought forward. The methodology brings snapshots of countries’ digital state-of-the-art and their ability to facilitate digital growth for multinational businesses.

Before we show you the results of these two studies, essentials…

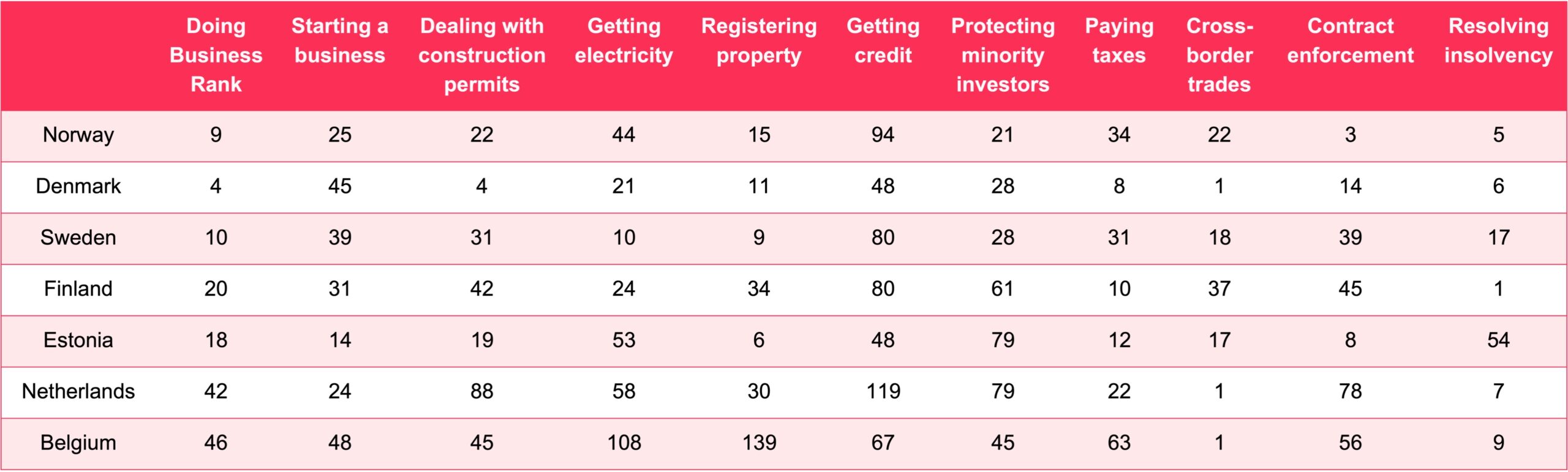

The Evaluation Criteria Used In Studies

Doing Business. Is a measure used to evaluate and rank the performance of economies comparative to one another. A total of 41 different indicators, across 10 topics, are scored and sorted to create the rankings. These topics cover all aspects of starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, cross-border trades, contract enforcement, and resolving insolvency. In the end, all scores are processed and countries are ranked from 1 (best) to 190 (worst).

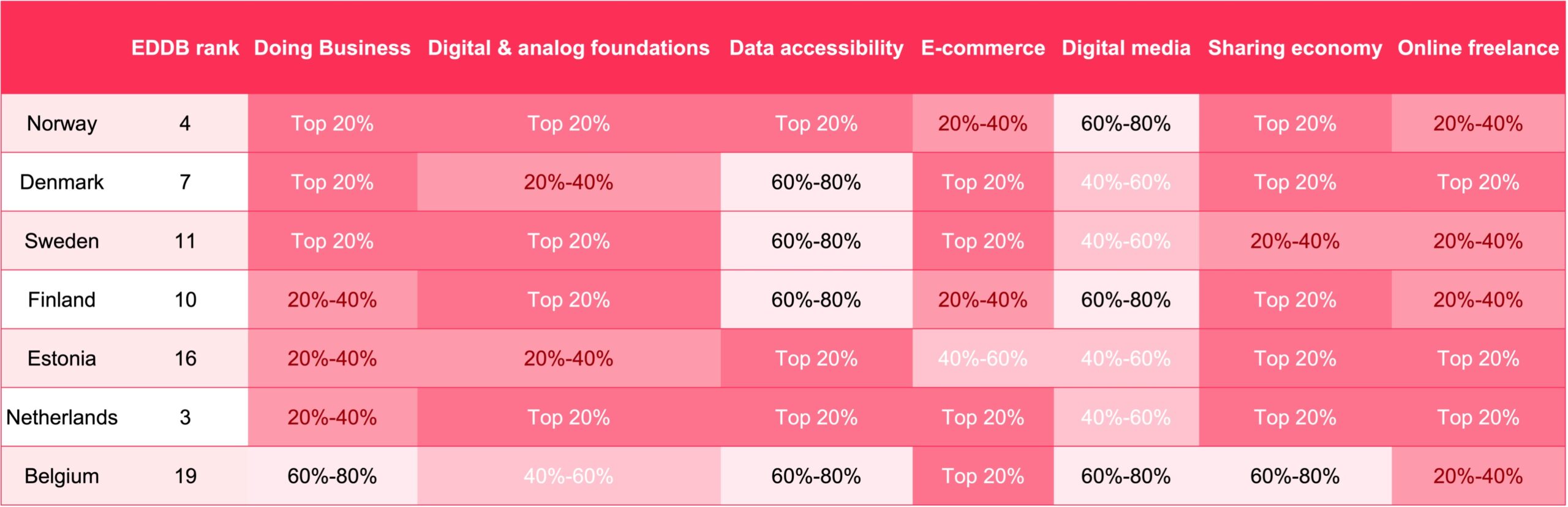

Ease of Doing Digital Business. Analyzes four essential digital platforms: e-commerce platforms (e.g. Amazon, eBay); digital media platforms (e.g. YouTube, Netflix); sharing economy platforms (e.g. Uber, Airbnb); and online freelance platforms (e.g. Upwork, Toptal). It looks into how hard it is for each of these platforms to enter, operate, thrive, or exit markets, and what the primary facilitators and barriers are. They believe these platforms are representative of any platform-centric digital companies to draw conclusions. The score is calculated from 236 variables from over 60 data sources for a total of 42 countries. There are 7 key measures scored: doing the business score, digital & analog foundations, data, accessibility, e-commerce, digital media, sharing economy, and online freelance. All countries are ranked on a scale from 1 to 42, where one is the best and 42 is the lowest possible score.

Both studies on the topic of “ease of doing business” were both done in 2019 and are still the most verifiable results available online that allow aggregate preview of the data. While there have been studies conducted, such as DESI (a publication from the European Union), it is important to note that these studies may not provide a comprehensive or holistic overview of the data at hand. By benchmarking these metrics against any upcoming studies, we can gain a deeper understanding of the current environment for conducting digital and business in general.

Country Rankings for Nordic and Benelux Regions

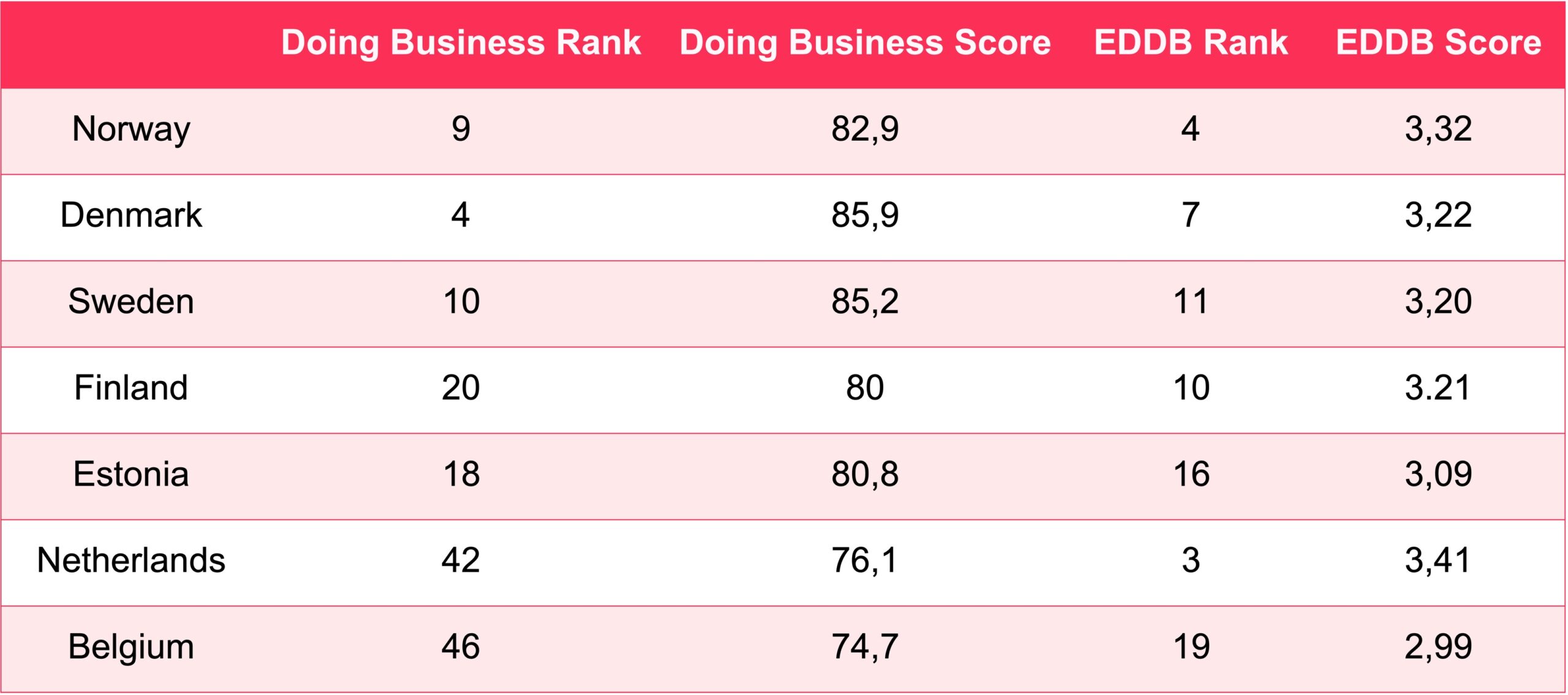

It would be nice if we could visualize these two different ranks together within the same table only for Nordics and Benelux countries. In fact, it would be even better if we could have three separate tables in this section.

- 1st table: both ranks crossed over in a simple table [Doing business + EDDB] (y-axis – countries, x-axis – doing business rank + score and EDDB rank + score)

- 2nd table: doing business rank table (y-axis – countries, x-axis – 10 topics scored by numbers or color intensity)

- 3rd table: EDDB rank table (y-axis – countries, x-axis 7 key measures scored by numbers or color intensity)

Now, each table would only include these countries and values listed below in the same order:

Nordic Strong, Netherlands Solid, Belgium to Catch Up

The Nordic countries have made remarkable progress when it comes to digital deployment. According to the Digital Evolution Index, these countries are considered some of the earliest and most advanced adopters of digital technology. One factor driving the region’s superior performance on the EDDB is its early embrace of subscription-based models for accessing digital news, subscription services, and media.

High purchasing power coupled with a high interest in online services, has resulted in more Nordic consumers engaging in online purchases. Not just locally, but cross-border. In fact, a third of all Nordic users engage in cross-border-e-shopping which is noticeably more compared to most other countries. Furthermore, their success can be partly attributed to an open government and perhaps even higher levels of trust between citizens. The combination appears to be particularly advantageous for opportune economic initiatives.

The Netherlands is also marching forward in digital transformation, having created a clear and comprehensive Digital Strategy in 2018 which sets out the government’s vision for achieving reputable digital eloquence. To prove the point, the most recent data by DESI has the Netherlands high in third place in the 2022 Digital Economy and Society Index.

Belgium on the opposite is still struggling to convert stout analog and digital basics into a “more hospitable environment” for digital-oriented businesses. Although scoring solidly in terms of ICT training in enterprises, infrastructural connectivity, and integration of digital technology by enterprises, it’s still lacking in a couple of categories. It shows mixed performance in terms of e-government and open-data readiness.